Call a representative

Monday-Friday, 8 a.m.-6 p.m. Pacific.

US: 441276457000

International: +1 650 466-1100

Fax: +1 650 466-1260

Deliver convenient customer experiences for the modern day insurance customer

A single claim or policy change can make or break a relationship in the experience economy. Deliver connected experiences that exceed expectations and create lasting loyalty.

There’s no need to be anxious during the claims process. With Genesys, companies provide proactive updates on claims activity.

Leverage the technology to reduce friction and connect frontline and back office teams to reduce effort and improve churn.

Make your insurance ecosystem more integrated. Improve speed to market, flexibility and scalability with an open cloud platform.

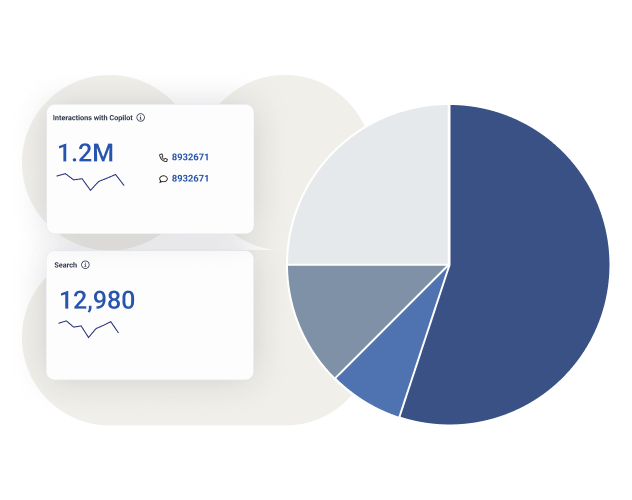

Learn the true drivers of inbound interactions and lost retention opportunities with journey management. Drive customer satisfaction and improve performance with deep customer insights and cross-functional coordination. Connect front-, middle- and back-office teams in a single workflow, keeping the customer in the loop all the way. From underwriting to claims, anticipate and address sales and service needs.

Insurance agencies and companies must deliver the best support every time, even more so during times of crisis. Use policyholder preferences — not carrier needs — to drive interactions.

Provide options along their journeys. Offer proactive communications about application status, claim status or payment notification. Enable customers to self-serve and avoid waiting in a queue for an insurance agent.

Carriers need to adapt and respond to fluctuating demands. But legacy core systems are often siloed by function, and may even have different data, processes, technology and outcomes.

Migrating to the cloud reduces maintenance costs, enables continuous innovation and streamlines support. It also makes it easy to enable remote work and access to new artificial intelligence (AI) and analytics features.

Policyholders want convenience and simplicity from their insurance company. And if they don’t get it, they will look elsewhere.

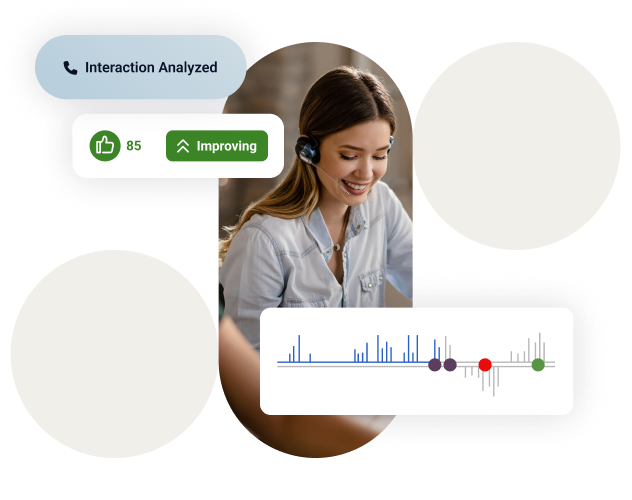

Leverage AI-powered bots and predictive capabilities throughout common processes. Use work automation to smooth processes and increase efficiency. Keep customers engaged and empower them with self-service — from requesting a quote to filing a claim. Gather insights to uncover training needs and improve customer relationships.

Give customers exceptional service without overworking insurance call center agents and staff. AI, virtual agents and other technologies deflect interactions, reduce handling times and improve efficiency.

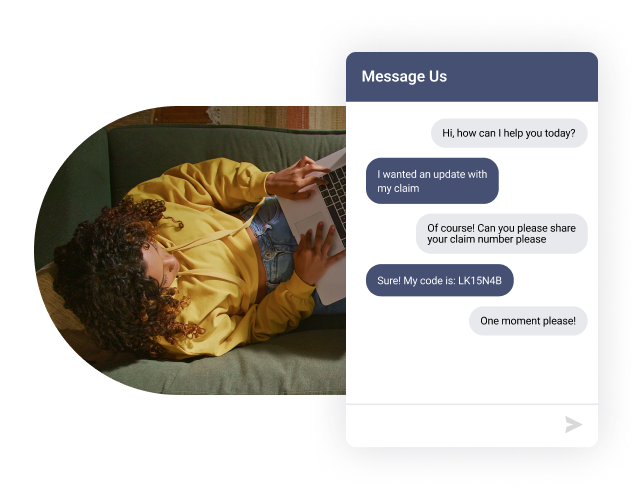

Meet customers on the channels they love most with meaningful, helpful content. And if they require more help, seamlessly guide them toward human support.

Unlock limitless potential by connecting Genesys with systems of record. Amplify self-service by leveraging systems like Guidewire and Duck Creek to promote automation for your book of business.

Power your sales, policy services and claims center with scalable personalized experiences.

Ensure the security and privacy of policyholder data across every interaction.

Deliver targeted omnichannel self-service across insurance experiences.

Interact with AI-powered bots while agents address challenging queries.

Use automation and digital channels for underwriting and claims to improve interactions and lower costs.

Know who’s visiting your website and why. Automatically direct them to the next best action.

Supervisors gain instant insights into performance, and employees see results in real time to drive their success.

Get a complete view of activities to drive better experiences and identify training needs.

Connect frontline agents and back office processes to fully understand and automate the end-to-end customer journey.

Genesys provides the insurance customer service software needed to connect interactions across touchpoints. With our support, you can provide better experiences for your customers and employees.

Learn how our cloud technology orchestrates effortless customer interactions across all channels.

Thank you for your interest.

We’ll contact you directly to set up a date and time that works with your schedule.

In today’s landscape, one of the most important features to look for is artificial intelligence (AI) capabilities. AI allows you to automate simple processes to allow your customer support team to focus on the most complex issues. It streamlines the personalization process by gathering and surfacing customer information when it’s needed. It helps supervisors analyze interactions faster and more thoroughly, locating coaching opportunities and taking bias out of reviews.

Customer self-service capabilities are also important for boosting efficiency. Through AI, your business can make it easier for customers to find the information they need on their own, without human intervention, using tools like virtual agents. Escalation to an agent is still possible — and is smoother and more streamlined when these tools are properly employed — but it happens less frequently, and the agent is given the information needed to transition quickly and proceed to problem-solving without having to repeat questions that have already been answered.

Customer service software can include tools that make communication significantly easier, including live chat; social media management and social listening; and outbound communications. Live chat allows agents (or virtual agents) to communicate with customers online in real time, helping to reduce call volume with a more efficient means of communication.

Social media management amplifies your social reach, allowing you to speak to customers, and social listening shows you what they’re saying about you so you can respond — either to them, or internally through process changes. And outbound communications through multiple channels take your voice directly to the customer, meaning you can communicate important information directly to those who need to hear it.

Customer service software allows insurance companies to manage claims more efficiently in a couple of ways. It allows you to provide proactive updates, rather than having to wait until a customer asks for news. When customers do reach out, communications are smoother and more streamlined. You can anticipate the needs of the policyholder and deliver them the answers they want.

Yes, there are several critical security measures to consider when evaluating insurance customer service software. First, ensure the software complies with industry regulations such as HIPAA, PCI-DSS, and local data protection laws like GDPR or CCPA. Data encryption is essential to protect sensitive customer information. Multi-factor authentication (MFA) should be a standard feature to prevent unauthorized access.

Additionally, look for solutions that offer robust user access controls, audit trails and real-time threat monitoring. Since insurance organizations handle a high volume of personally identifiable information (PII), it’s also important to assess how vendors manage data storage, backup and disaster recovery.

Ask vendors about their incident response plans and whether they undergo regular third-party security audits or penetration testing. Look for transparency into a vendor’s security posture and clear documentation to support compliance. Ultimately, security should be a top-tier evaluation criterion — not just a checkbox — when selecting software that will serve as a critical interface between your brand and your policyholders.